The green arc of steel’s transition

Emerging technologies are poised to reduce the steel industry’s environmental impact, creating compelling investment opportunities in the sector

Showcasing Impax’s original thinking on the challenges and opportunities arising from the transition to a more sustainable economy.

Emerging technologies are poised to reduce the steel industry’s environmental impact, creating compelling investment opportunities in the sector

Digital tools and innovative products are enabling the financial sector to better serve evolving customer demands, especially in emerging markets where vast unmet needs remain

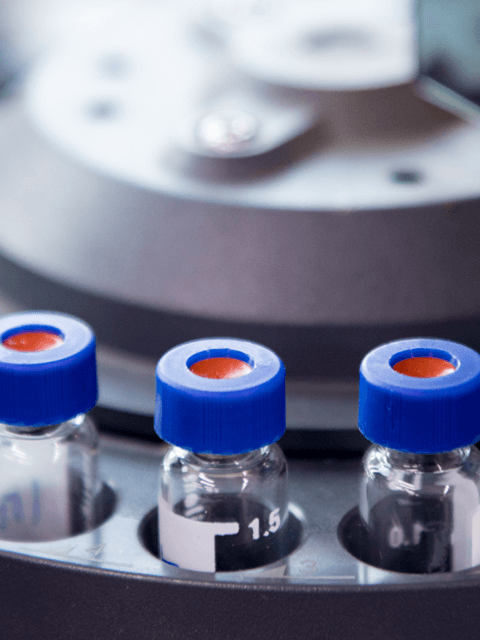

We believe the urgent need to detect, treat and destroy ‘forever chemicals’ in the world’s water is creating investment opportunities that are broader and more valuable than many appreciate

Suppliers of critical products and services to world-leading industries are playing a key role in the transition to a more sustainable economy

The scale of exposure to nature-related risks means investors must urgently understand the drivers of biodiversity loss and invest in ways to reduce them

World-leading innovation means the US is home to a breadth of exciting – and under-researched – smaller healthcare companies that are improving outcomes for patients and providers

With US jobs, leadership and investment returns at stake, we must embrace the transition to a cleaner, more resilient economy

An expected doubling of the world’s grids by 2050 is creating compelling opportunities for companies with the materials and know-how to create a new backbone for the global energy system

Circular innovations are reducing hospitals’ environmental impacts – and lowering costs

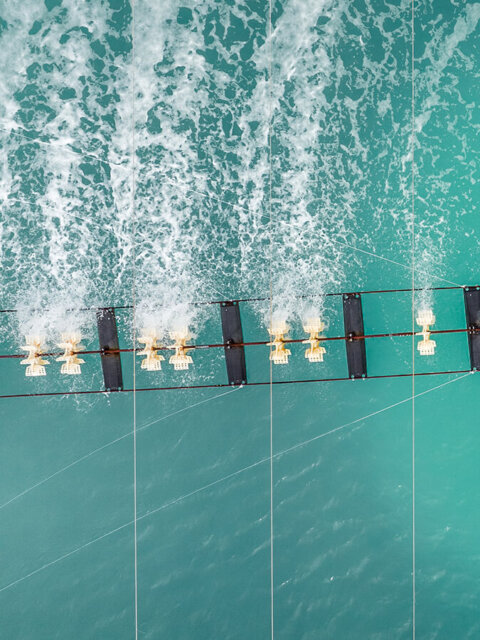

Innovative technologies are reducing the environmental impact of a water-intensive industry critical to the modern economy

Published by CleanTechIQ, featuring Chris Dodwell and Charlie Donovan

In this video, Chris Dodwell discusses the implications of the COP28 climate summit, reflecting on the impact of a net-zero roadmap for the global food system

From hearing aids to vitamins, solutions that boost wellness can tap into growing demand

Specific practices advancing gender equity provide a window into culture, and stronger cultures contribute to better performance.

We share our perspectives on key themes that we believe will shape opportunities in global markets in 2024 and beyond.

Five important outcomes that we believe must emerge from this UN climate summit.

Dislocation in the offshore wind market creates investment opportunities

The US residential solar market has faced recent setbacks, but structural drivers for long-term performance remain intact

Measuring contributions to the transition to a more sustainable economy